Table Of Content

- 1. How advertising in the auto sector has evolved across various mediums?

- 2. Why TV Remains a Dominant Ad Platform for the Auto Sector?

- 3. The role of print in auto-advertising

- 4. The role of radio in auto advertising

- 5. Digital advertising the challenging landscape

- 6. Key insights and latest advertising trends

- 7. Conclusion

The automotive industry is going through big changes, and so is the way brands are advertising. As consumer habits and media choices shift, auto advertisers need to adjust their strategies to stay ahead. TV is still a strong platform for building brand awareness, while print media is making a surprising comeback, especially in regional markets. Radio is also growing steadily as a cost-effective option, but interestingly, digital ad spending is dropping even though more advertisers are using it. To succeed, auto brands must explore new strategies to get the best results from their advertising budgets.

In this blog, we’ll explore key trends shaping auto advertising in the years 2022, 2023, and 2024. You'll learn why TV remains a powerful tool for visibility, how print media is gaining traction, and why radio is becoming more popular. We’ll also explain why digital ad spending is decreasing and what strategies auto brands should adopt to stay competitive. Whether you’re an auto marketer, media planner, or just curious about the industry, this blog will give you the latest insights and practical tips to navigate the changing world of automotive advertising. First of all let’s discuss how advertising in the auto sector has evolved across various mediums.

How advertising in the auto sector has evolved across various mediums?

Auto advertising has changed a lot over the years. In the early 2000s, TV and print were the main ways car brands advertised, with big budgets going toward national campaigns. In the 2010s, digital platforms like search engines, social media, and online ads became more popular, shifting the focus to online marketing. But between 2022 and 2025, traditional media like TV, print, and radio have made a strong comeback as people’s viewing and listening habits have changed.

Between 2022 and 2025, auto advertising has seen big changes in both traditional and digital media. While digital was once expected to take over, TV, print, and radio have gained importance again. Now, car brands are using a mix of traditional and digital advertising to increase brand awareness and reach more customers effectively.

Why TV Remains a Dominant Ad Platform for the Auto Sector?

The Power of Television Advertising

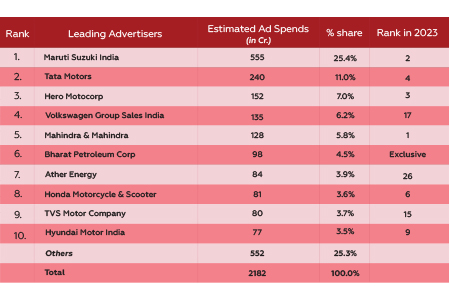

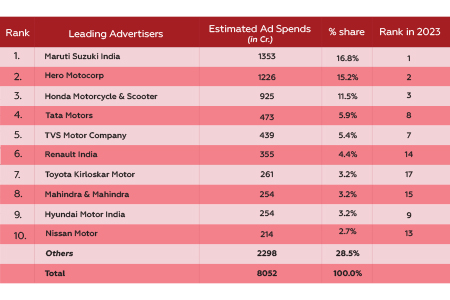

Even with the rise of digital media, television remains the top advertising platform for auto brands. Major manufacturers like Maruti Suzuki and Tata Motors continue to dedicate a large portion of their ad budgets to TV. But why does TV remain so effective?

Massive Reach & High Viewer Engagement

TV has a wide audience reach, making it a powerful tool for brand awareness. Unlike digital ads that can be skipped or blocked, TV commercials hold viewers’ attention, especially during live sports and entertainment shows. This makes TV ads more impactful and memorable for consumers.

Consistent Growth in Ad Spend

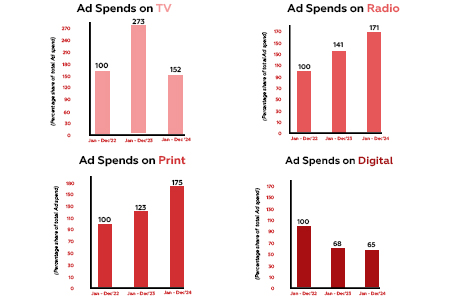

Spending on TV ads in the auto sector doubled in 2023 compared to 2022. Another 52% increase was recorded in 2024, showing that TV remains the preferred platform for auto brands. This consistent growth reflects the strong performance and influence of TV advertising.

Multi-Screen Influence

TV advertising creates a ripple effect across other platforms. After watching a TV ad, many consumers search for the brand online, increasing engagement on digital platforms. This multi-screen influence helps brands reinforce their message and drive better results.

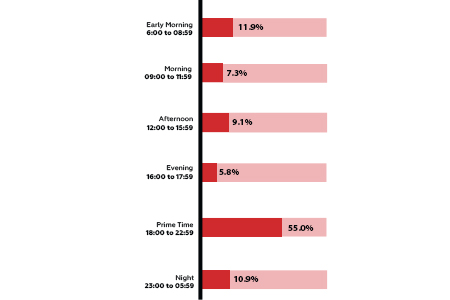

Peak Time Slots and Channel Preferences for Auto Ads

Auto ads are carefully scheduled to maximize reach and engagement. Prime time (6:00 PM – 10:59 PM) accounts for 55% of all auto ads aired, as it attracts the largest audience. Early morning slots (6:00 AM – 8:59 AM) target commuters, while late-night ads (11:00 PM – 5:59 AM) reach professionals and tech-savvy audiences.

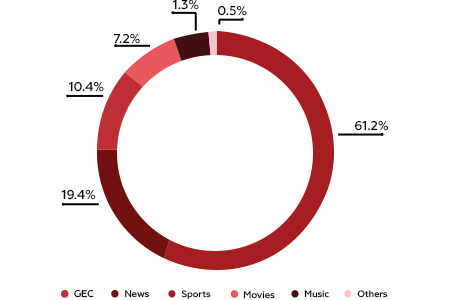

Most Preferred TV Channels for Auto Ads

Sports channels lead the way, with 61.2% of auto ad spending in 2024 going to channels like Star Sports 1 HD and its regional versions. News channels, including News18 India and ABP Majha, accounted for 19.4% of spending, while general entertainment and movie channels like Sony Entertainment TV and Star Gold are used for family-focused car ads like SUV and sedan.

The role of print in auto-advertising

Why Print Media Continues to Thrive in Auto Advertising

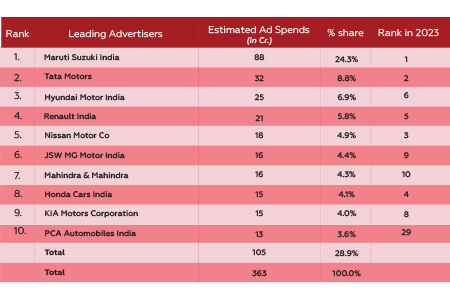

Even though digital media is popular, print media is still very effective, especially in regional markets. Auto brands like Hero Motocorp and Honda continue to spend on ads in newspapers and magazines because they help reach local audiences effectively.

Regional Preferences and Leading Publications

Print ads are especially popular in certain regions. The North Zone leads with 42.5% of total auto ad spending, with cities like Jaipur and Delhi driving this trend. The West Zone follows with 25.9%, with Mumbai and Pune being key markets. Popular publications for auto ads include Dainik Bhaskar, Patrika, Times of India, and Lokmat, which have a strong regional and national presence.

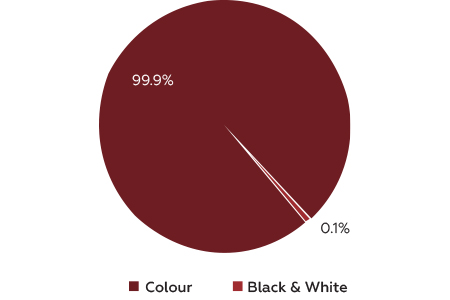

Why Color Ads Dominate Print Media

In 2024, 99.9% of auto sector print ads were in color because they grab attention better and are easier to remember. Strategic placement also matters — 47.7% of the ads were placed on the back pages for visibility, 31.5% on inside pages for detailed reading, and 20.8% on front pages for maximum impact.

The role of radio in auto advertising

Radio continues to be a cost-effective and engaging way to reach local audiences. It allows auto brands to connect with people during their daily routines, such as commuting or working. Ad spending on radio increased by 71% in 2024 compared to 2022, showing that brands recognize the value of this medium in building brand awareness and influencing purchase decisions.

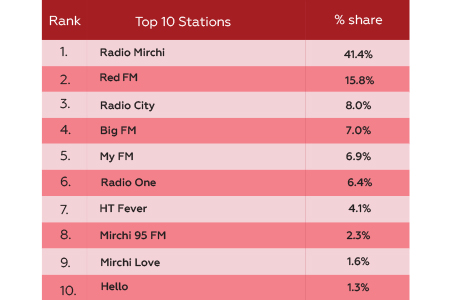

Top Radio Stations for Auto Advertising

Certain radio stations have become favorites for auto advertising. Radio Mirchi leads with 41.4% of total auto ad spending, making it the top choice for auto brands. Red FM, with 15.8%, is especially popular among younger listeners, while Big FM accounts for 7.0% of the spending, reaching both urban and semi-urban audiences effectively.

Digital advertising the challenging landscape

Why Is Digital Ad Spending Declining?

Even though more auto brands are advertising online, digital ad spending dropped by 35% in 2024. This decline is due to rising costs and lower returns on investment (ROI). Many consumers are also experiencing ad fatigue and using ad blockers, making it harder for brands to get their message across. As a result, auto brands are shifting toward TV and print, which offer better brand recall and stronger audience engagement.

Popular Digital Ad Formats

Despite the decline, display ads remain the most used format, accounting for 84.5% of digital auto ads, though their effectiveness is decreasing. Video ads, which make up 15.5% of spending, are gaining traction because they generate higher engagement but are still underutilized. The most popular platforms for auto ads are Facebook (63.1% share), YouTube (11.8%), and X (formerly Twitter) (8.9%).

Key insights and latest advertising trends

To maximize reach and impact, auto brands should focus on different platforms based on their strengths. TV is ideal for building mass awareness, especially during prime-time slots and on popular sports and news channels. Print media works well for targeting regional audiences, particularly in Tier 2 and Tier 3 cities where newspapers have strong presence. Radio remains a cost-effective option for reaching commuters through top FM stations. For digital platforms, brands should shift from static ads to interactive formats like 360-degree car views, which engage viewers more effectively.

Emerging Advertising Trends

Video-first advertising is becoming more popular, with platforms like YouTube and Instagram Reels gaining traction for auto ads. Localized and hyper-personalized marketing is also growing, as geo-targeted ads are proving to be more effective in reaching the right audience. A hybrid advertising approach combining TV, print, radio, and digital is delivering the best results for auto brands by ensuring a wider and more consistent reach.

Conclusion

The automotive advertising landscape is changing rapidly, and brands must adapt to stay competitive. While digital media was expected to dominate, traditional platforms like TV, print, and radio have made a strong comeback due to their reliable reach and engagement. TV remains the top choice for mass awareness, print media continues to thrive in regional markets, and radio offers a cost-effective way to connect with local audiences. Although digital ad spending has declined due to higher costs and ad fatigue, video ads and interactive formats still hold potential for future growth. A balanced approach that combines TV, print, radio, and digital advertising will help auto brands maximize their impact and stay ahead in the evolving market.

Looking for expert guidance? Excellent Publicity specializes in high-impact, data-driven advertising solutions tailored for automotive brands.

Contact us today to create powerful campaigns that drive brand awareness and maximize ROI.

FAQs

TV reaches a large audience and keeps viewers engaged, especially during prime-time shows and sports events. It helps build strong brand recall.

Radio reaches local audiences and is cost-effective. It works well during commute hours, with stations like Radio Mirchi and Red FM being popular choices.

Print works well in local markets because people trust newspapers. Ads in top papers help auto brands reach specific audiences effectively.

Digital ads are getting expensive, and people are using ad blockers more. This makes it harder for brands to get good results, so they are spending more on TV and print.

Using a mix of TV for large reach, print for local targeting, radio for affordable engagement, and digital for interactive ads is the most effective approach.